Sample 3b

Teacher notes

Teacher notes

The following page provides you with a sample IA, graded under the new criteria and was part of the sample provided to workshop leaders, during the recent IB workshop training. Sample number 3b - macroeconomics. It is designed to be graded alongside sample number 3a, 3c and F(III).

Commentary 2

Title of the article: The country with the world’s most progressive taxes has the world’s highest income inequality

Source of the article: Washington Post

https://www.washingtonpost.com/news/wonk/wp/2017/07/16/what-american-liberals-could-learnfrom-south-africa/?utm_term=.5738f496ae30 (Accessed 10 October 2017)

Date the article was published: 16 July 2017

Date the commentary was written: 10 November 2017

Word count of the commentary: 781words

Unit of the syllabus to which the article relates: Macroeconomics

Key concept being used: Equity

The Washington Post

The country with the world’s most progressive taxes has the world’s highest income inequality

By Max Ehrenfreund July 16

South Africa has the world's most progressive tax system, according to a new report. South Africa is also, by another measure, the world's most unequal country -- making it a cautionary example for U.S. liberals about the limited power of taxation to remedy inequality.

South Africa has the world's most progressive tax system, according to a new report. South Africa is also, by another measure, the world's most unequal country -- making it a cautionary example for U.S. liberals about the limited power of taxation to remedy inequality.

Yes, taxing the rich more and the poor less can have benefits, but many experts argue inequality is more meaningfully addressed by spending on public programs that provide for people's basic needs while giving them an opportunity to get ahead.

In particular, that requires ensuring people have access to education, training, transportation and health care. And funding those enterprises requires more than just soaking the rich. In northern European countries -- where economists have found that people who are born poor are more likely to make it into the middle class -- governments also rely on broad taxes that force the middle class to pay more as well.

"The basic story is taxes do not change the income distribution," said Graham Glenday, a tax scholar at Duke University who was born in Cape Town, South Africa and plans to retire there.

"Changing the income distribution is much more of a dynamic thing that comes about if poor people can actually move up," he said. "That obviously takes, sometimes, generations."

The new report, published Sunday by Oxfam, ranks 152 countries on how well their economic policies are designed to address inequality. South Africa ranks first on taxation. The rich pay steeper rates, the corporate tax is hard to shirk and a national value-added tax includes exemptions for food and other staples that are major expenses for the poor.

The new report, published Sunday by Oxfam, ranks 152 countries on how well their economic policies are designed to address inequality. South Africa ranks first on taxation. The rich pay steeper rates, the corporate tax is hard to shirk and a national value-added tax includes exemptions for food and other staples that are major expenses for the poor.

"It’s quite an efficient system that tries, to the extent that’s possible, to really, kind of, balance the equation," said Sipho Mthathi, the director of Oxfam South Africa. "It is one of the most efficient tax systems in the world."

But despite ranking first in tax redistribution, South Africa ranks slides to 21st in the overall measure of addressing inequality, just ahead of the United States at 23rd. A poor score on the labor market -- South Africa does not have a minimum wage, for example -- brings down thecountry's general ranking.

The other countries in the top 25 are all developed nations, almost all of them in Europe. Sweden ranks first, followed by Belgium, Denmark and Norway. There are many methods of measuring inequality, but among the most common is the Gini coefficient -- a measure of the share of income that would have to be redistributed to achieve perfect equality. Based on the Gini coefficient, South Africa is the most unequal country in the world among those for which data are available, according to the World Bank.

As of 2011, the most recent year for which data are available from the bank, the coefficient was 0.63 in South Africa. Data from the Organization for Economic Cooperation and Development (OECD) show that inequality has increased in South Africa since 2000, when the Gini coefficient was 0.58.

The coefficient for the United States was just 0.41 as of 2013, but that figure is still relatively high for a rich country. It is difficult to compare economic policies across countries. Different approaches may work better for some countries than others, and the data is not always available in the same form. Any ranking necessarily involves a degree of subjective judgment.

For instance, Oxfam did not rank countries' systems of taxation according to a strict measure of fiscal progressivity, that is, the distribution of the burden on people of different levels of income. (The northern European and Scandinavian tax systems also perform well in the report, despite the relatively high taxes paid by the middle class in those countries.)

Instead, the authors of the report considered several factors. South Africa performed well on all of them. The South African government consistently collects between 27 percent and 29 percent of the country's gross domestic product in revenue, Glenday said. He added that those numbers are comparable to those for the United States -- where general government revenue totaled 33.5 percent of GDP in 2015, according to the OECD.

That is despite the fact that the United States is a much richer country, where taxpayers can afford to pay much more. In the United States, GDP per person is more than 10 times that of South Africa.

Indeed, Americans pay only 68 percent to 71 percent of the maximum amount of taxes that the government could theoretically collect, according to researchers at the International Monetary Fund. The estimates for South Africa are higher -- between 75 percent and 76 percent, depending on how the maximum is calculated.

South Africa is able to collect so much in taxes in part because of a bureaucracy that is unusually effective for a developing country. While corruption is a serious problem in South Africa, the tax authorities have a reputation for professionalism. "They collect it very competently," Glenday said.

Hefty penalties for cheating the system discourage abuse, according to Mthathi. "It’s created a culture where it’s not easy for people to just not follow the rules," she said.

Another factor that might make South Africa's tax system particularly progressive is that about one fifth of tax revenue comes from taxes on corporate income. That is roughly twice the share of U.S. taxes that is paid by corporations.

People who own corporations, whether privately or in the form of publicly traded stock, tend to be wealthier, and most economists believe that steeper corporate taxes tend to favor the poor and the middle class. An important exception is Kevin Hassett, President Trump's nominee to serve as chairman of the White House's Council of Economic Advisers. Hassett has argued that workers wind up paying a substantial share of corporate taxes in the form of reduced wages.

By Oxfam's reckoning, though, the United States would fall in the rankings from 23rd to 29th if Trump's agenda were implemented.

Despite decades of progressive, efficient tax policy in South Africa, the country's extreme inequality is stubbornly persistent. "It doesn’t mean that the country doesn’t have problems," Mthathi said.

In particular, she said, South Africa could spend the money that it collects more efficiently to reduce poverty and create opportunity. The problem of corruption makes it more difficult for the government to achieve those aims.

And as Glenday pointed out, South Africa's public education system is notoriously poor -- a grave obstacle to economic development over the long term. That is arguably a legacy of the era of apartheid, when schools for white students were much better than those for students of other ethnicities.

Without good tax policy, South Africans might be much worse off, but that country's example suggests that progressive taxes on their own are not a solution to inequality.

"It’s not just about collecting money, and making sure that is done is fairly and progressively," Mthathi said.

Commentary

This article illustrates the problems associated with income inequality and inequity. Contrary to popular belief, despite having the world’s most progressive tax system in the world, South Africa has high income inequality. What might be the implications of the Gini coefficient of South Africa and how does progressive tax influence the income distribution?

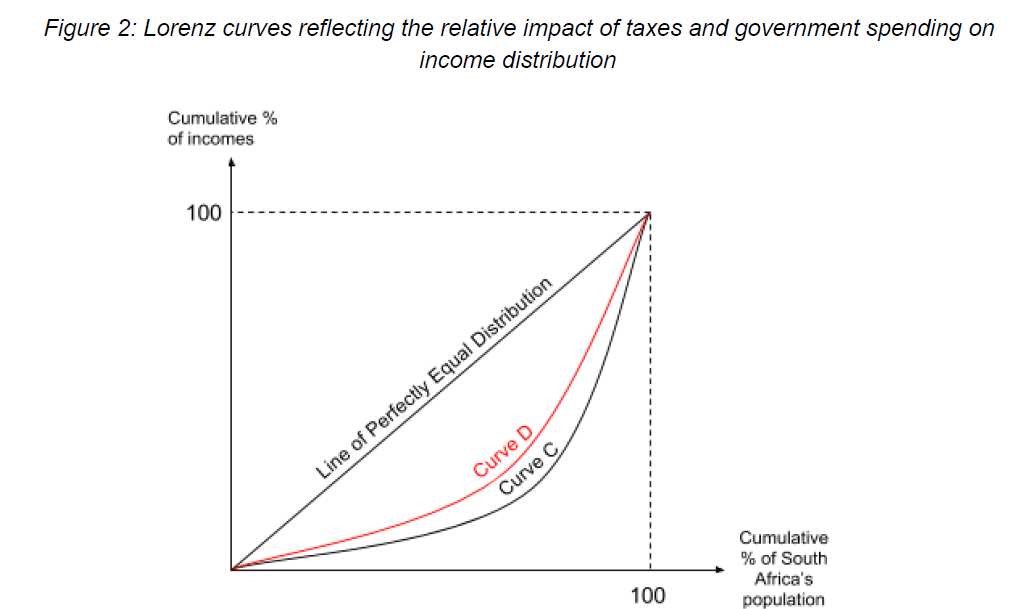

Progressive taxes are usually designed to reduce the inequality between people by taxing the higher income workers  proportionately more than the lower income workers. As the article mentions, it is often considered to be a “remedy to inequality”, implying that there is more equity. However, South Africa still has a high degree of income inequality. It is mentioned that the Gini coefficient in 2011 was 0.63. This is illustrated in the diagram to the right, with income distribution in the diagram where the gini coefficient = area (A) / areas (A+B).

proportionately more than the lower income workers. As the article mentions, it is often considered to be a “remedy to inequality”, implying that there is more equity. However, South Africa still has a high degree of income inequality. It is mentioned that the Gini coefficient in 2011 was 0.63. This is illustrated in the diagram to the right, with income distribution in the diagram where the gini coefficient = area (A) / areas (A+B).

Naturally, the question will follow: Why, despite the progressive tax, does South Africa have a wide gap in the income distribution? Inequality may depend on the productivity of resources owned, non-competitive labor markets, stage of economic development of the country, the type of economy, society and culture, luck, or a combination of these.

However, the flaw in this article is that it does not make it clear whether the Gini coefficient provided is for pre-tax income or disposable income. If the Gini coefficient is for pre-tax income, the problem is the significant difference in the wages the workers are receiving. This means that the reasoning provided by the article is insufficient because with the pre-tax figures, no measure of the relationship between income inequality and progressive taxes has been provided. Perhaps, the Gini coefficient for the disposable income will actually show that the world’s most progressive tax does indeed greatly reduce inequality.

On the other hand, if the Gini coefficient is for disposable income, it is implied that the progressive taxes may not have as  much influence on the redistribution of income as expected, which supports the article’s viewpoint. The diagram below shows that effect on income distribution due to government spending may be greater than the progressive taxes.

much influence on the redistribution of income as expected, which supports the article’s viewpoint. The diagram below shows that effect on income distribution due to government spending may be greater than the progressive taxes.

In the model to the left, the Lorenz curve C reflects the income distribution of South Africa before taxes are imposed, due to other factors such as inefficient government spending. Then the effect of the progressive taxes is shown by the less curved Lorenz curve D. It is shown that the taxes will only slightly make the area enclosed by the curve smaller. Therefore, the model above illustrates the possibility that progressive taxes are indeed not very effective in remedying inequality, as the article suggests.

However, the article also states that inequality in South Africa may be due to corruption and a lack of spending on infrastructure, educational and health facilities. While it may be true that the tax system itself has severe penalties for cheating it, corruption could occur afterwards. This suggests that the tax is not being used effectively to counter eventual structural unemployment due to lack of education; the problem lies with the effective utilization of the tax revenue and not the progressivity of the tax.

This is significant because it implies that progressive taxes, while less effective on their own, could lead to effective supply-side policies using the tax revenues, if corruption decreases.

Measures such as increased education and training would encourage occupational mobility and lower unit costs, shown by the  movement of the short run aggregate supply curve to the right from SRAS1 to SRAS2. This will also reduce frictional and structural unemployment due to a more flexible labor force and increased quality and quantity of the production of goods. Furthermore, investment in human capital is an increase in the quality of the factors of production with higher productivity, which can be represented by a shift the long run aggregate supply curve (LRAS1 to LRAS2) of South Africa. If used correctly, progressive tax revenues may lead to sustained economic growth and reduced income inequality in the future.

movement of the short run aggregate supply curve to the right from SRAS1 to SRAS2. This will also reduce frictional and structural unemployment due to a more flexible labor force and increased quality and quantity of the production of goods. Furthermore, investment in human capital is an increase in the quality of the factors of production with higher productivity, which can be represented by a shift the long run aggregate supply curve (LRAS1 to LRAS2) of South Africa. If used correctly, progressive tax revenues may lead to sustained economic growth and reduced income inequality in the future.

Limitations of the economic theory used include the fact that effects of other factors used to promote income equality, such as transfer payments, government subsidies and intervention in the labor markets have not been compared thoroughly in order to assess the effectiveness of the progressive tax in improving equity.

Economists will also have to observe the effects in the long run to make viable conclusions, as South Africa is a developing country and has the potential for higher economic growth. In conclusion, the ambiguity in the article about the source of South Africa’s large Gini coefficient makes the extent of the influence of progressive taxes in reducing inequality questionable, although the tax system does appear to be less significant than that of government expenditure in promoting equity.

Internal assessment criteria—SL and HL

Use the official IB economics IA criteria when assessing this work, available at: IA criteria

Portfolio (SL/HL)

Criterion A: Diagrams

Level descriptor

The response includes two different models in their diagrams. Each diagram is correctly labelled and a suitable title is included. The candidate recognizes that the Lorenz curve diagram cannot be used for any predictive purposes, but only as an illustration. Explanations are clear and focused. (3/3)

Criterion B: Terminology

Level descriptor

Relevant terminology with concise and precise definitions of economic terms e.g. progressive tax and Gini coefficient are indcluded. Supply-side policies, unemployment, capital, etc are correctly demonstrated. (2/2)

Criterion C: Application and analysis

Level descriptor

The Lorenz curve model is relevant and correctly applied in the article. The response uses the AD/AS model effectively and uses it to analyse the importance of investment in infrastructure and human capital. (3/3)

Criterion D: Key concept

Level descriptor

The key concept of equity is mentioned initially and in the conclusion. It is used appropriately in the commentary and is the correct concept to use for this article. However, the commentary appears to get slightly confused about the difference between equality and equity. The difference between the two terms required a fuller explanation. (2/3)

Criteria E: Evaluation

Level descriptor

Critical and focused evaluation with reference made in the third paragraph regarding the ambiguity of the information in the article itself. The candiate argues effectively that without additional policies to go alongside progressive taxation, any distribution policy is likely to be ineffective. (3/3)

General comments

The candidate picked a suitable article, selected an appropriate command term and produced a very good overall commentary. The overall score for this commentary was 13/14.

The third commentary in this sample can be accessed at: Sample 3C